“Shorting crypto” is a term that frequently echoes through the halls of the financial trading world. It’s a trading strategy used by investors and traders who anticipate a decline in an asset’s price. In the world of cryptocurrency, learning how to short can be a valuable tool in your trading toolkit.

1. What Does “Shorting Crypto” Mean?

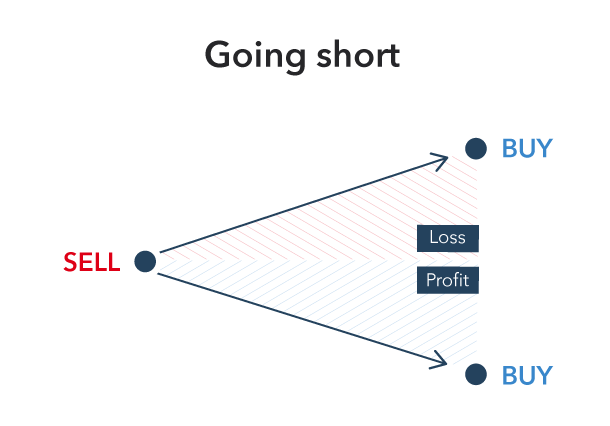

To short, or short sell, means to sell an asset that you do not own with the expectation that the asset’s price will decrease. If the price does decrease, you can buy the asset back at a lower price, making a profit from the difference. If the price rises, however, you’ll have to repurchase the asset at a higher price, resulting in a loss.

2. How to Short Cryptocurrencies: A Step-by-Step Guide

i. Choose a Trading Platform

The first step to shorting crypto is to choose a suitable trading platform that allows short selling. Some popular choices include Binance, Kraken, and Bitfinex. These platforms provide advanced trading options like futures and margin trading, which are essential for shorting.

ii. Set Up Margin Trading

To short sell, you’ll need to enable margin trading. Margin trading allows you to borrow funds from the platform to place trades. Remember, margin trading increases both potential profits and potential losses.

iii. Open a Short Position

Once margin trading is enabled, you can open a short position. This involves borrowing the cryptocurrency you wish to short and selling it at the current market price.

iv. Close the Short Position

After the price has dropped, you can buy back the borrowed cryptocurrency and return it to the lender. The difference in price is your profit. If the price increases, you may decide to cut your losses and close the position before it increases further.

3. Tools to Aid Short Selling

Various tools can support your short selling activity:

i. Trading Platforms

As mentioned, platforms like Binance, Kraken, and Bitfinex allow short selling. Choose a platform with a user-friendly interface, strong security measures, and competitive fees.

ii. Technical Analysis Tools

Tools for technical analysis can help predict price movements. TradingView, for instance, offers a range of indicators and charting tools.

iii. Spot On Chain

Spot On Chain is a valuable tool that simplifies the complex world of on-chain analytics, providing traders with insights that can guide their short selling decisions. Features like multi-chain token visualization, alerts on large transactions, and a newsfeed of readily processed on-chain signals empower traders of all levels.

4. The Risks of “Shorting crypto”

While “Shorting crypto” can be profitable, it’s not without risk. Cryptocurrency prices are notoriously volatile, and short selling carries the potential for unlimited losses, as there’s no upper limit to how much an asset’s price can increase.

As a trader, it’s crucial to manage these risks effectively. Use risk management tools, stay informed about market trends, and never invest more than you’re willing to lose.

Conclusion

“Shorting crypto” in the cryptocurrency market can be a powerful strategy when used effectively. By understanding the process, utilizing the right tools, and managing risk, traders can capitalize on market downturns. However, due to its high-risk nature, shorting should be used judiciously and with a clear understanding of potential outcomes. As always, informed decisions are the key to successful trading.

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.