Crypto Ponzi schemes are a hot topic in the world of cryptocurrency. Some people believe that crypto is just a Ponzi scheme, while others see it as a legitimate investment opportunity. In this article, we’ll take a closer look at what a Ponzi scheme is, how they work, and whether or not crypto is a Ponzi scheme.

What is a Ponzi Scheme?

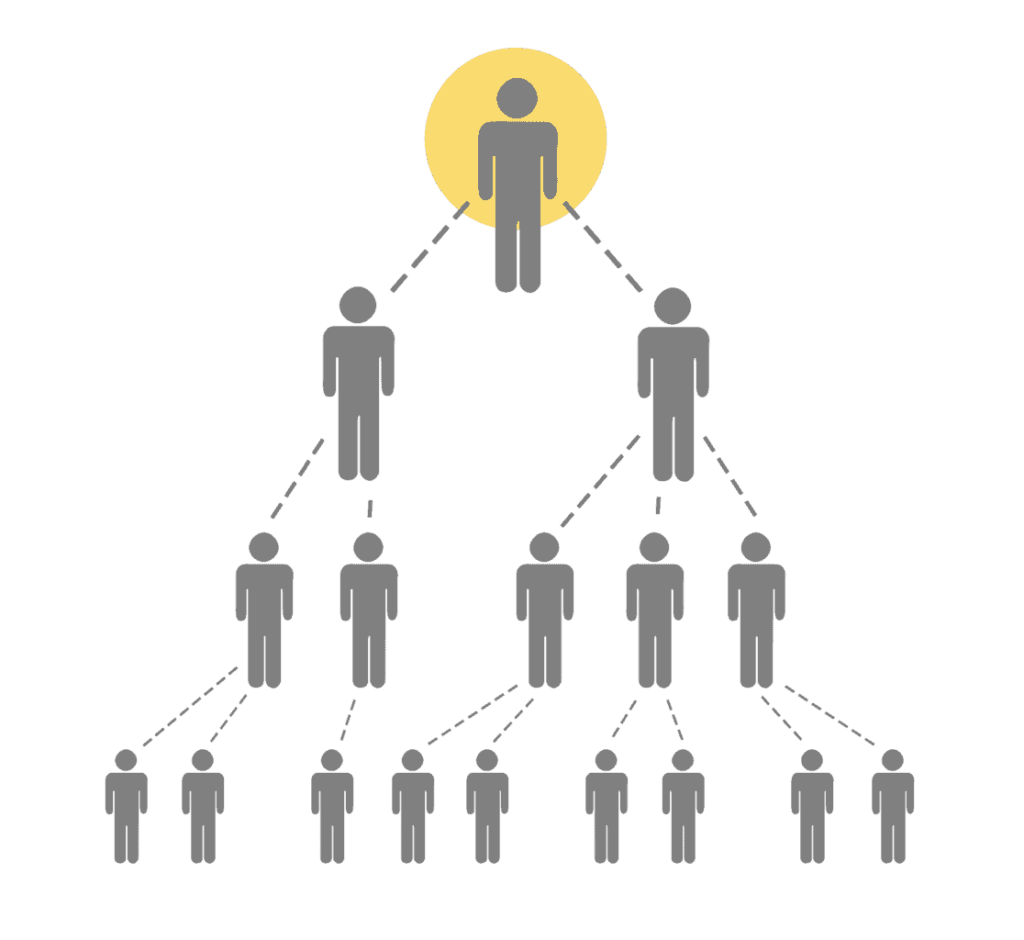

A Ponzi scheme is a fraudulent investment scheme in which returns are paid to earlier investors using the capital of newer investors. The scheme relies on the continuous recruitment of new investors to generate returns for existing investors, rather than generating legitimate profits through investments.

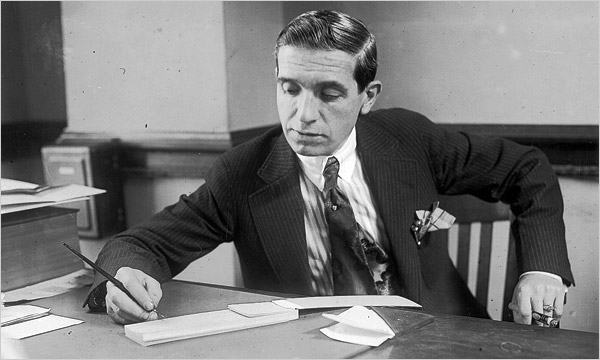

Ponzi schemes are named after Charles Ponzi, who famously ran a fraudulent investment scheme in the early 20th century. Ponzi schemes are illegal and can lead to severe financial losses for investors.

How do Ponzi Schemes Work?

In a Ponzi scheme, the fraudster promises high returns on investment to attract new investors. The initial investors receive returns that are paid using the capital of new investors, creating the illusion of profitability.

As the scheme grows, the fraudster must continually recruit new investors to pay returns to existing investors. Eventually, the scheme collapses when it becomes impossible to attract new investors, or existing investors withdraw their funds.

Is Crypto a Ponzi Scheme?

Crypto is not a Ponzi scheme. While there have been instances of fraudulent investment schemesin the cryptocurrency space, the vast majority of cryptocurrencies are legitimate investments that operate on a decentralized, blockchain-based system.

Cryptocurrencies are based on a distributed ledger system that allows for transparent and secure transactions. Transactions are recorded on a blockchain, which is a decentralized ledger that is maintained by a network of computers. This makes it nearly impossible for a single entity to manipulate the system for fraudulent purposes.

However, there have been instances of fraudulent investment schemes in the cryptocurrency space. One example is Bitconnect, which was a lending platform that promised high returns on investment. The platform was later exposed as a Ponzi scheme, and investors lost millions of dollars.

It’s important to note that not all cryptocurrency investment opportunities are scams. There are many legitimate investment opportunities in the cryptocurrency space, such as buying and holding established cryptocurrencies like Bitcoin and Ethereum, or investing in promising new projects through initial coin offerings (ICOs).

How to Avoid Crypto Ponzi Schemes

To avoid falling victim to a crypto Ponzi scheme, it’s essential to do your due diligence before investing. Here are some steps you can take to protect yourself:

- Research the project: Before investing in a cryptocurrency, research the project thoroughly. Look for information about the team behind the project, the technology they’re developing, and any partnerships they’ve formed.

- Check the whitepaper: Many cryptocurrency projects publish a whitepaper that outlines their technology and business model. Read the whitepaper to get a better understanding of the project’s goals andhow they plan to achieve them.

- Look for red flags: Be wary of investment opportunities that promise high returns with little to no risk. Ponzi schemes often use these tactics to lure in unsuspecting investors.

- Use reputable exchanges: When buying and selling cryptocurrencies, use reputable exchanges that have a track record of security and reliability.

- Diversify your investments: Don’t put all of your money into a single cryptocurrency or investment opportunity. Diversify your portfolio to reduce the risk of losses.

Conclusion

While there have been instances of fraudulent investment schemes in the cryptocurrency space, crypto is not a Ponzi scheme. The vast majority of cryptocurrencies are legitimate investments that operate on a decentralized, blockchain-based system. However, it’s important to do your due diligence before investing in any cryptocurrency or investment opportunity to avoid falling victim to a Ponzi scheme.

By researching the project, checking the whitepaper, looking for red flags, using reputable exchanges, and diversifying your investments, you can make informed investment decisions and navigate the exciting and ever-evolving world of cryptocurrency.

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.