Cryptocurrency Value: How does it gain value?

Cryptocurrency has been a hot topic in the financial world for several years now. Bitcoin, the most well-known cryptocurrency, has had a significant impact on the financial sector since its inception in 2009. Today, there are thousands of cryptocurrencies available on the market, with many investors seeking to profit from their increasing value. In this article, we will explore the different factors that determine cryptocurrency value, with a focus on the keyword “Cryptocurrency Value.”

Step 1: Utility

A cryptocurrency’s usefulness, or utility, is the first factor that determines its value. For example, Bitcoin’s usefulness in online transactions has led to increased demand, driving up its value.

Step 2: Scarcity

Scarcity is the second factor that determines cryptocurrency value. As the supply of a cryptocurrency becomes more limited, demand for it will increase, driving up its value.

Step 3: Demand

Demand refers to how much people are willing to pay for a cryptocurrency. The more demand there is for a cryptocurrency, the higher its value will be.

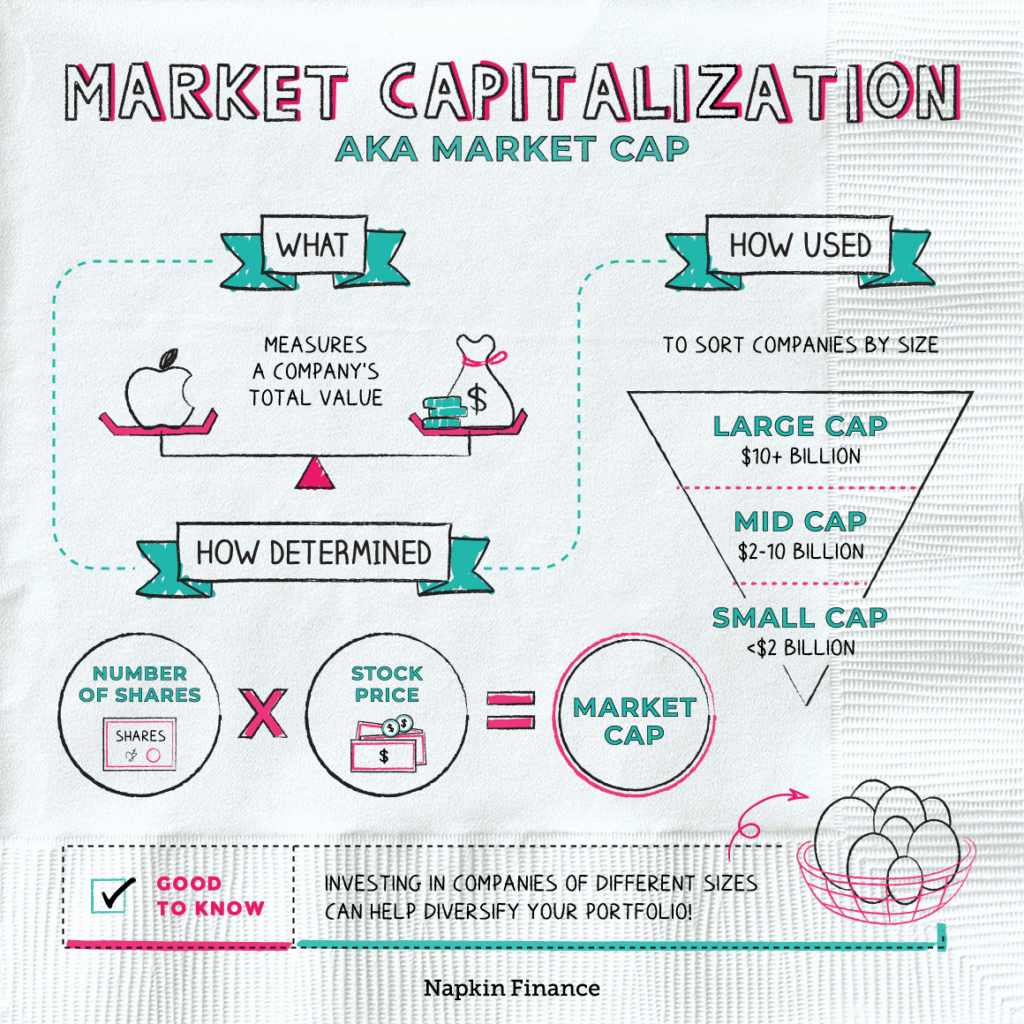

Step 4: Market Capitalization

Market capitalization is the total value of all the coins in circulation. The higher the market capitalization of a cryptocurrency, the more valuable it is considered to be.

Step 5: Network Effect

The network effect refers to the idea that the more people use a cryptocurrency, the more valuable it becomes. This is because as more people use cryptocurrency, it becomes more widely accepted, and its utility increases.

Understanding these factors is essential for investors seeking to profit from cryptocurrency investments and maximize their profits while minimizing their risks.

Tools involved in the process of determining cryptocurrency value include cryptocurrency exchanges, market data websites, technical analysis tools, and fundamental analysis tools. These tools allow investors to track the value of their investments and make informed decisions.

In conclusion

Cryptocurrency value is determined by utility, scarcity, demand, market capitalization, and the network effect. By understanding these factors and utilizing the right tools, investors can make informed decisions and maximize their cryptocurrency investments.

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.