DeFi protocols leveraging Liquid Staking Derivatives (LSDs), also known as LSDFi, were the talk of 2023 in anticipation of Ethereum’s Shapella upgrade.

In 2023, one of the most significant developments in the DeFi space has been the emergence of Liquid Staking Derivatives (LSDs), coinciding with the Shapella upgrade for Ethereum. To put it simply, the projects are financial instruments that function as receipts for staked tokens within a DeFi protocol, allowing users to stake their tokens while retaining the flexibility to use these LSDs in other decentralized applications (DApps).

The importance of LSDs for Ethereum lies in the fact that staked ETH was previously locked up on the beacon chain until the Shapella upgrade. LSDs provided a much-needed solution for stakers to access liquidity while their ETH tokens secured the blockchain. With the successful completion of the Shapella upgrade, staking has become a more attractive opportunity for ETH bulls, leading to an increase in the popularity of LSD protocols. In fact, LSD protocols have surpassed decentralized exchanges (DEXs) in total value locked (TVL), with a current TVL of approximately $19.5 billion.

As LSDs gain popularity, a sub-sector of DeFi has emerged to capitalize on this trend. LSDFi protocols build on top of LSD tokens to increase their utility and create yield opportunities for LSD token holders. These opportunities include borrowing against LSD tokens, speculating or hedging against LSD token yields, creating indexes of LSD tokens, and more.

This article aims to delve into some of the most popular LSDFi protocols and provide insights on how DeFi users can maximize their potential.

Quick take Top 5 LSDFi gems

1. Lybra Finance

A decentralized stablecoin protocol that has gained both usage and attention. You can mint a stablecoin (eUSD) with stETH as collateral. They recently launched their v2 proposal.

- Integration w/Layer Zero w/ ability to send eUSD to Arbitrum

- Supports all major LSTs

- Revamped Tokenomics

- Deflationary mechanism through “Dynamic Liquidity Provisioning”

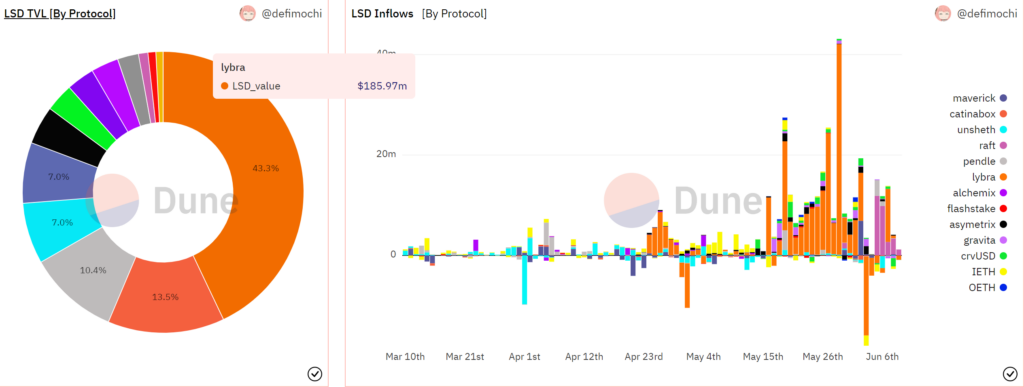

According to data from Dune, 47% (or $181M) of all LSDs locked in protocols are in Lybra. This is the first LSDfi protocol to gain product market fit.

2. Tenet Protocol

The most ambitious LSDFi protocol. Layer-2 that uses a basket of LSDs as the base asset. Narrative-wise, it’s impossible to ignore:

- LSDs

- AI-powered wallet

- Cross-chain – Layer Zero

This stands out due to its vision of what an L2 can become. Still, we are weary of projects with this level of hype and marketing. These are ambitious goals I hope they can deliver on.

The idea is to build an ecosystem around LSDs from all major blockchains to unlock added value from them. It’s a unique approach for an L1 that operates on external assets, similar to Berachain in that way.

Tenet will have their own LSDfi product suite including a stablecoin (LSDC) that can be borrowed at 0% interest on your staked LSD position. Meaning users who stake and earn additional rewards on their LSDs will also be able to borrow against it at no cost.

The major selling point of Tenet is their incentive structures. They can bootstrap users quickly by tapping into the $20B market of LSD holders looking for extra yield/utility on their assets.

For LSD holders looking to allocate in search of yield, Tenet has some appeal over other LSDfi projects:

- They allow utilization of LSDs across ALL integrated blockchains

- The LSDs will be composable across the full ecosystem of dapps built on Tenet

- Staked LSDs can borrow LSDC at no interest

- There are higher security guarantees with staking on a blockchain than depositing into a smart contract

3. Parallax Finance

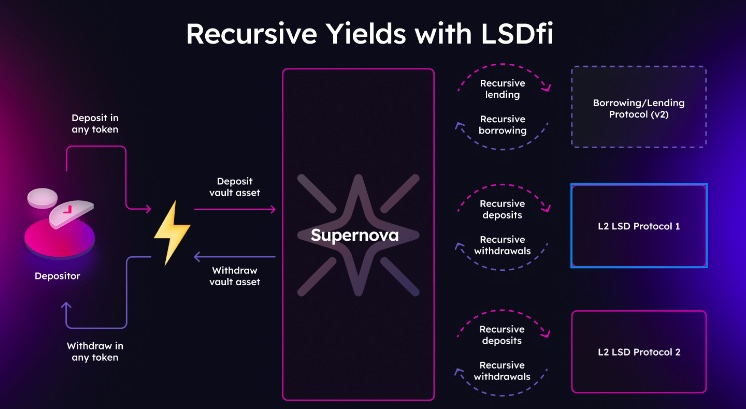

Another LSDFi gem project is Parallax. Parallax wants to be the liquidity backbone for DeFi. Their mission is to provide safe and easy yield opportunities for all of crypto. Supernova is their LSD-based yield project

How it works:

- Deposit ANY asset

- Receive yield from multiple LSD projects

- Recursively grow yield

- Withdraw into ANY asset

Though Parallax is yet to launch, they’ve got an IDO on the horizon. Definitely, one to watch.

4. Asymetrix

Similar to PoolTogether, Asymetrix is a yield protocol that encourages saving. Process:

- A group of users each deposit stETH into Asymetrix.

- Daily balance increases at the Lido APR %.

- Weekly winners take home stETH rewards.

The concept is interesting and provides an opportunity for small stakers to earn larger rewards than what would be otherwise possible. With the ability to withdraw funds at any time, this approach has proven to be an effective way to encourage savings. For instance, Premium Bonds, a similar savings product in the UK alone, holds around $100 billion in savings.

5. Cat-in-a-Box Finance

A Self-sustaining lending protocol with LSDs as collateral. Deposit your stETH, borrow a synthetic asset (boxETH), and still earn yield on your deposits.

Use Cases:

Recursive yield – buy more LSDs with borrowed funds

Fees – from LPing, resolving loans, etc

Boosted yield – overcollateralized positions are rewarded with higher yield

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.