Leverage trading crypto is a popular trading strategy that allows you to trade with more funds than you actually have, potentially increasing your profits. In this article, we’ll explore what leverage trading crypto is and how it works.

What Is Leverage Trading Crypto?

Leverage trading crypto is a trading strategy that allows you to borrow funds from a broker or exchange to increase your trading position. Essentially, you are trading with borrowed funds, which can increase your potential profits but also increase your potential losses. Leverage trading is also known as margin trading.

How Does Leverage Trading Crypto Work?

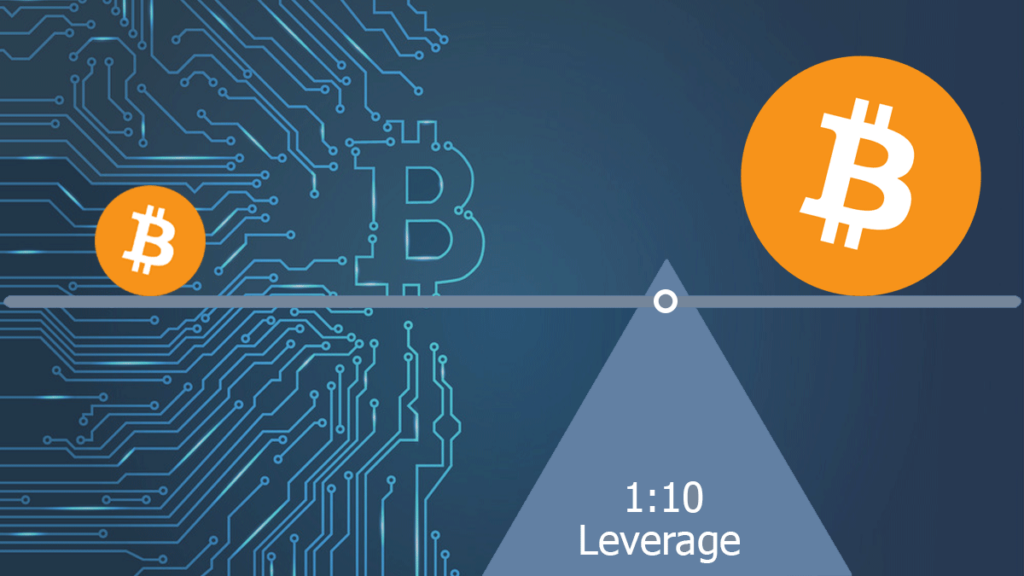

Let’s say you want to buy $10,000 worth of Bitcoin, but you only have $1,000 in your trading account. With leverage trading, you could borrow the remaining $9,000 from a broker or exchange. The amount you can borrow is known as the leverage ratio, and it can vary depending on the broker or exchange.

For example, if the leverage ratio is 10:1, you would only need to put down $1,000 of your own funds and could borrow the remaining $9,000. If the price of Bitcoin then increases by 10%, you would make a profit of $1,000 (10% of $10,000) instead of just $100 (10% of $1,000). However, if the price of Bitcoin decreases by 10%, you would lose $1,000 instead of just $100.

It’s important to note that leverage trading can amplify your profits, but it can also amplify your losses. If the market moves against you, you could lose more than your initial investment.

Tools for Leverage Trading Crypto

There are several tools you can use for leverage trading crypto. One popular option is a margin trading platform, such as BitMEX or Bybit, which allows you to trade with leverage up to 100:1. These platforms also offer features like stop-loss orders to help limit your losses.

Another option is to use a CFD (contract for difference) trading platform, such as eToro or Plus500. CFDs allow you to trade on the price movements of cryptocurrencies without actually owning them, and you can also use leverage to increase your trading position.

Conclusion

Leverage trading can be a powerful tool for increasing your potential profits in crypto trading, but it can also increase your potential losses. It’s important to understand how leverage trading works and to use it with caution. Always do your research and choose a reputable broker or exchange, and consider using risk management tools like stop-loss orders. With the right approach, leverage trading can help you achieve success in crypto trading.

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.