After the price of Bitcoin saw a series of green candles, rising from $24,800 to over $31,000 within a week, the price of BTC has been moving sideways. This is also the first time BTC has returned to the $30,000 range in two months since April 14th.

Bitcoin is gradually entering the “belief phase”

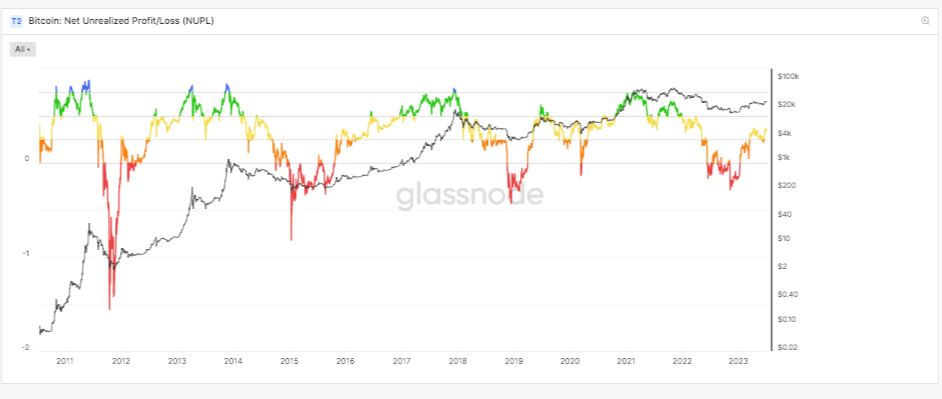

When using Glassnode’s NUPL chart, it can be seen that the current market is in the “optimistic” phase. Compared to 2019, the market at that time had a significant recovery and entered the “belief” phase. Bitcoin actually peaked in 2019 and underwent a downward correction before the Halving in 2020.

Currently, we are witnessing a historical event repeating itself. BTC has increased by about 90% since the beginning of 2023 until now. The NUPL index is gradually entering the “belief” phase, and many speculate that BTC will begin a downward correction before the Halving event in 2024.

However, all events that occur are only for reference, and some events may be correct but still not completely match what has happened. Two possible scenarios may appear:

- The market will sharply decline to the $20,000-$24,000 range before the Halving event and then continue to rise.

- The market will only experience a slight correction to the $26,000-$28,000 range and then continue to rise strongly.

The current Fear & Greed Index is at 64, indicating that greed is gradually appearing. Many people believe that the crypto market will continue to rise strongly and there are signs of FOMO.

Join our rigorously growing community of on-chain data-driven crypto traders here