Crypto trends are constantly evolving, making it challenging to stay ahead of the game. However, by analyzing crypto trends, you can gain valuable insights into market behavior and make informed trading decisions. In this article, we’ll explore how to analyze crypto trends and the tools you can use to gain a competitive edge.

Understanding Technical Analysis

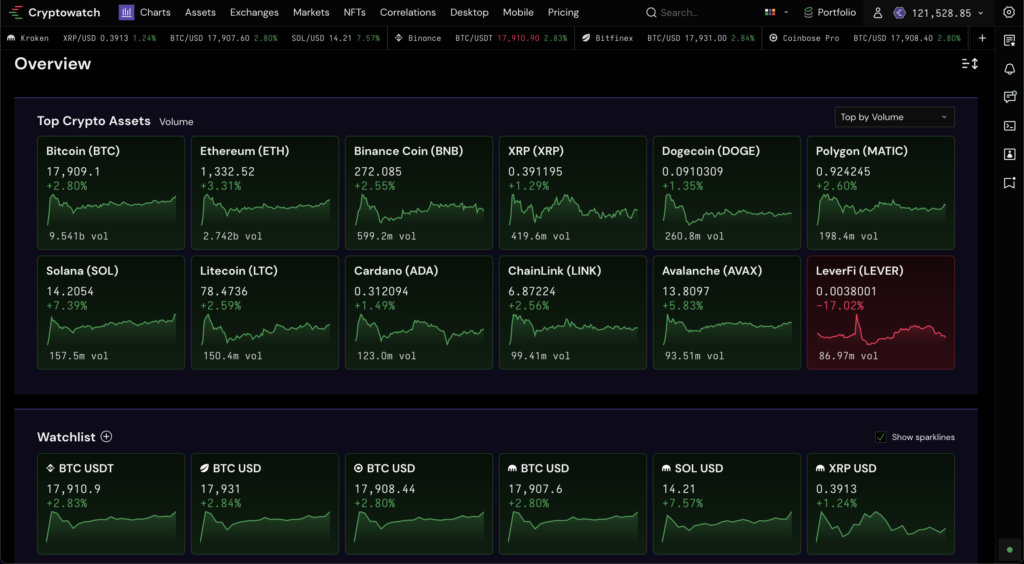

Technical analysis is a popular method of analyzing crypto trends. It involves studying price charts and identifying patterns that can help predict future price movements. Technical analysis tools like TradingView and CryptoWatch allow you to customize charts and add technical indicators like moving averages, Bollinger Bands, and Relative Strength Index (RSI). By using these indicators, you can identify potential trends and make informed trading decisions.

Understanding Fundamental Analysis

Fundamental analysis involves analyzing the underlying factors that drive the value of a cryptocurrency. This includes factors like the technology behind the cryptocurrency, the team behind the project, and the overall market conditions. By conducting thorough research and analysis, you can gain insights into the potential long-term value of a cryptocurrency and make informed investment decisions.

Understanding Sentiment Analysis

Sentiment analysis involves analyzing social media and news sentiment to gain insights into market sentiment. Sentiment analysis tools like LunarCrush and TheTIE analyze social media and news sentiment and provide insights into market behavior. By tracking the sentiment of influential crypto Twitter accounts and news articles, you can gauge market sentiment and predict potential trends.

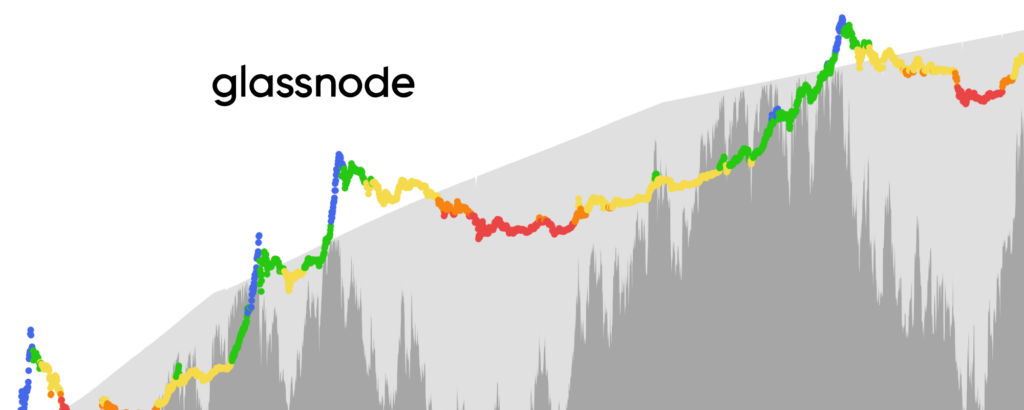

Understanding On-chain Analytics On-chain analytics involves analyzing blockchain data to gain insights into market behavior. On-chain analytics platforms like Glassnode and Santiment offer metrics like transaction volume, network activity, and wallet balances. By tracking the movements of crypto whales, you can anticipate potential market shifts and adjust your trading strategy accordingly.

Combining Different Analysis Methods

To gain a comprehensive understanding of crypto trends, it’s important to combine different analysis methods. By using technical analysis, fundamental analysis, sentiment analysis, and on-chain analytics, you can gain a 360-degree view of the market and make informed trading decisions.

Using Crypto News Aggregators

Crypto news aggregators like CoinDesk, CryptoSlate, and Crypto Briefing compile news and analysis from various sources and present them in one place. By keeping up with the latest news and analysis, you can gain a better understanding of the factors that influence crypto prices and predict potential trends. These platforms also offer newsletters and alerts that keep you updated on the latest developments in real-time.

Conclusion

Analyzing crypto trends is an essential part of successful crypto trading, and using the right tools can make all the difference. By using technical analysis tools, fundamental analysis, sentiment analysis, on-chain analytics, and crypto news aggregators, you can gain valuable insights into market behavior and stay ahead of the game. Remember, investing in cryptocurrency can be risky, and it’s important to do your own research and seek professional advice before making any investment decisions.

To stay ahead of the game and predict crypto trends, it’s important to use a combination of these tools and stay up to date on the latest developments in the market. Technical analysis allows you to analyze price charts and identify potential trends, while fundamental analysis involves analyzing the underlying factors that drive the value of a cryptocurrency. On-chain analytics provide insights into the behavior of crypto whales, and sentiment analysis gives you a better understanding of market sentiment. Finally, crypto news aggregators compile news and analysis from various sources, providing you with a comprehensive overview of the market.

By using these tools, you can gain valuable insights into potential crypto trends and adjust your trading strategy accordingly. Remember to combine different analysis methods to gain a comprehensive understanding of the market, and stay up to date on the latest developments in the crypto world.

In conclusion, analyzing crypto trends is a crucial aspect of successful crypto trading. By using the right tools, including technical analysis tools, fundamental analysis, sentiment analysis, on-chain analytics, and crypto news aggregators, you can gain valuable insights into market behavior and stay ahead of the game. Remember to do your own research and seek professional advice before making any investment decisions. By using these tools and staying up to date on the latest developments in the market, you can anticipate potential trends and make informed trading decisions, giving you a competitive edge in the fast-paced world of crypto trading.

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.