Staking Crypto: Is it Safe?

Staking has become an increasingly popular way for investors to earn passive income with their cryptocurrency holdings. However, as with any investment, there are risks involved. In this article, we will explore the safety of staking crypto and the tools involved in secure staking.

What is Staking Crypto?

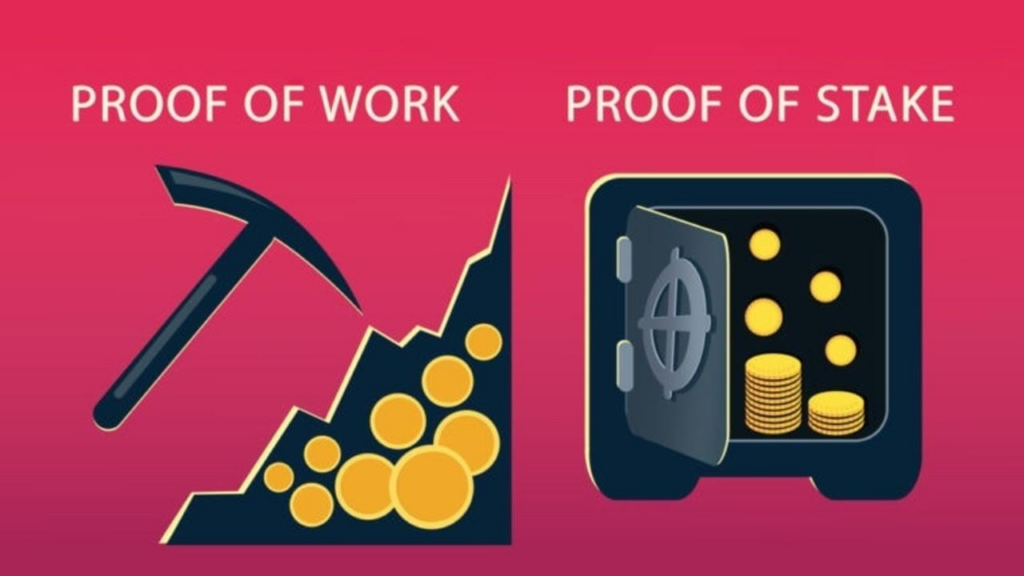

Staking involves holding cryptocurrency in a wallet and contributing to the validation of transactions on a blockchain network. By doing so, stakers are rewarded with additional cryptocurrency as an incentive for their contributions to the network.

Is Staking Crypto Safe?

While staking crypto can be a lucrative investment opportunity, there are risks involved. One of the main risks is the possibility of losing your staked funds due to hacks or network failures. Therefore, it is important to take precautions to ensure secure staking.

Tools for Secure Staking

- Choose a Reliable Staking Platform: When choosing a staking platform, it is important to do your research and choose a reliable platform with a good track record of security and reliability.

- Use a Hardware Wallet: A hardware wallet is a physical device that stores your cryptocurrency offline, making it less susceptible to hacks. Using a hardware wallet for staking can help keep your funds secure.

- Diversify your Staking Portfolio: Diversifying your staking portfolio can help reduce the risk of losing all of your staked funds. By staking multiple cryptocurrencies on different networks, you can spread out your risk and increase your chances of earning rewards.

- Keep Up to Date with Security Measures: It is important to stay informed about the latest security measures and best practices for secure staking. This includes keeping your software and hardware up-to-date, using strong passwords, and enabling two-factor authentication.

- Research the Network: Before staking on a network, it is important to research its security measures and history of hacks. This can help you make an informed decision about whether or not to stake on that network.

Conclusion

In conclusion, staking crypto can be a safe and lucrative investment opportunity, but it is important to take precautions to ensure secure staking. By choosing a reliable staking platform, using a hardware wallet, diversifying your staking portfolio, keeping up-to-date with security measures, and researching the network, you can minimize the risks of staking and maximize your potential rewards.

As with any investment, it is important to weigh the risks and benefits before staking your cryptocurrency. By following these tips for secure staking, you can make an informed decision about whether staking is right for you and ensure the safety of your investment.

On-chain analytics play a crucial role in crypto trading by providing insightful data about transaction patterns and trends directly from the blockchain. These analytics can help traders understand market sentiment, identify potential investment opportunities, and make more informed decisions. By analyzing factors like transaction volumes, active addresses, and large transactions (often associated with ‘whales’), traders can gain deeper insights into the health and activity of a particular blockchain.

Spot On Chain is a revolutionary platform in this domain. It simplifies the process of on-chain analytics, making this valuable data accessible and comprehensible for all traders, regardless of their technical expertise. By offering real-time, user-friendly analytics, Spot On Chain empowers traders to leverage on-chain data effectively and make strategic trading decisions.